Graham stock screener

If you’re looking for graham stock screener images information related to the graham stock screener topic, you have visit the right blog. Our site always provides you with hints for seeking the highest quality video and picture content, please kindly hunt and find more enlightening video articles and graphics that fit your interests.

Graham Stock Screener. Start Today From Only 200. Advertentie Buy Sell Real Stocks With Regulated EU Stock Brokers. NCAV Screener in Excel Using MarketXLS. We have created a NCAV screener template that downloads the latest list of the SP500 stocks calculates the NCAV per Share for each stock gets their trading price and then filters the stocks based on the NCAV bargain buying approach.

Stock Screener Benjamin Graham Meetinvest From meetinvest.com

Stock Screener Benjamin Graham Meetinvest From meetinvest.com

You will need a licensed copy of MarketXLS to use the template. In an article in ET Dr Vikas V Gupta has explained the rigorous filter that he put the stocks through to identify the value stocks. Benjamin Graham and Warren Buffett. Commission Free Global Stocks Trading With Industry Leading Spreads on PC Mobile. Advertentie no need to pay - 18 signals a day. The All-In-One Guru Stock Screener.

Start Today From Only 200.

Contrary to common belief Benjamin Graham and David Dodd did not provide any indication that they used a formula or a specific algorithm for determining intrinsic value of a common stock. Following the spirit of Benjamin Graham and David Dodds teachings we assume that intrinsic value V of a stock is composed of the following three components on a per share basis. Advertentie Buy Sell Real Stocks With Regulated EU Stock Brokers. Get immediate access for 2250 or try the free Classic Graham Screener instead. He wrote several books on the stock market and his investment strategy has influenced some of the best investors in the world - including Warren Buffett. The difference between them is called the margin of safety.

Source: valuewalk.com

Source: valuewalk.com

Graham focuses on finding companies with stock that is undervalued against its intrinsic value. Filter out all companies with sales less than Rs 250 cr. Advertentie Buy Sell Real Stocks With Regulated EU Stock Brokers. The stock screener compares intrinsic value of a stock with its current market price the difference between them is called the margin of safety. In The Intelligent Investor Benjamin Graham provides a simple formula that in his own words only approximates the results of the more elaborate calculations in vogue for the valuation of growth stocks.

Source: investexcel.net

Source: investexcel.net

He wrote several books on the stock market and his investment strategy has influenced some of the best investors in the world - including Warren Buffett. Advertentie Buy Sell Real Stocks With Regulated EU Stock Brokers. Benjamin Graham and Warren Buffett. Filter out all companies with sales less than Rs 250 cr. The difference between them is called the margin of safety.

Source: financetasy.com

Source: financetasy.com

The stock screener compares intrinsic value of a stock with its current market price. Commission Free Global Stocks Trading With Industry Leading Spreads on PC Mobile. The screener now has more than 120 filters for you to screen your favorite stocks. NCAV Screener in Excel Using MarketXLS. Advertentie Buy Sell Real Stocks With Regulated EU Stock Brokers.

Source: oldschoolvalue.com

Source: oldschoolvalue.com

The stock screener compares intrinsic value of a stock with its current market price. Graham sees great potential for higher returns through investment in undervalued companies which is. Advertentie Buy Sell Real Stocks With Regulated EU Stock Brokers. The All-In-One Guru Stock Screener. Contrary to common belief Benjamin Graham and David Dodd did not provide any indication that they used a formula or a specific algorithm for determining intrinsic value of a common stock.

Source: bielefeld-heute.loawalking.it

Source: bielefeld-heute.loawalking.it

Benjamin Graham Stock Screener. According to them security analysis does not seek to determine exactly what is the intrinsic value of a given security. Advertentie Buy Sell Real Stocks With Regulated EU Stock Brokers. Benjamin Grahams Net-Net Investing Strategy Stock Screener The net-net investing strategy was developed by the father of value investing Benjamin Graham and extensively used by his student Warren Buffett in his early years. In an article in ET Dr Vikas V Gupta has explained the rigorous filter that he put the stocks through to identify the value stocks.

Source: lifetimeinvestor.com

Source: lifetimeinvestor.com

Benjamin Graham is considered the father of value investing and a stock market guru. You will need a licensed copy of MarketXLS to use the template. Why do investors use stock screeners anyway. Graham focuses on finding companies with stock that is undervalued against its intrinsic value. All these companies file financial information at least once a year and most file quarterly.

Source: newtraderu.com

Source: newtraderu.com

In an article in ET Dr Vikas V Gupta has explained the rigorous filter that he put the stocks through to identify the value stocks. Get immediate access for 2250 or try the free Classic Graham Screener instead. You will need a licensed copy of MarketXLS to use the template. About Graham Formula Stock Screener. Sequential stock screening involves reducing the universe of stocks to a manageable size.

Source: finbox.com

Source: finbox.com

Start Today From Only 200. Start Today From Only 200. The All-In-One Guru Stock Screener. Filter out all companies with sales less than Rs 250 cr. Benjamin Graham and Warren Buffett.

Source: seekingalpha.com

Source: seekingalpha.com

Get immediate access for 2250 or try the free Classic Graham Screener instead. As of 2018 there were 42099 listed companies worldwide of which 4397 were in the US stock markets. Start Today From Only 200. Graham focuses on finding companies with stock that is undervalued against its intrinsic value. Why do investors use stock screeners anyway.

Source: cherven.eu

Source: cherven.eu

Advertentie no need to pay - 18 signals a day. Contrary to common belief Benjamin Graham and David Dodd did not provide any indication that they used a formula or a specific algorithm for determining intrinsic value of a common stock. Companies with sales lower than this are very small companies and might not have the business stability and. Advanced Benjamin Graham Stock Screener. 101 rijen Stock Screener Stock Ideas The Benjamin Graham Formula.

Source: netnethunter.com

Source: netnethunter.com

The stock screener compares intrinsic value of a stock with its current market price the difference between them is called the margin of safety. Benjamin Graham Stock Screener. As of 2018 there were 42099 listed companies worldwide of which 4397 were in the US stock markets. Start Today From Only 200. He wrote several books on the stock market and his investment strategy has influenced some of the best investors in the world - including Warren Buffett.

Source: taldavidson.com

Source: taldavidson.com

Filter out all companies with sales less than Rs 250 cr. NCAV Screener in Excel Using MarketXLS. As of 2018 there were 42099 listed companies worldwide of which 4397 were in the US stock markets. The difference between them is called the margin of safety. About Graham Formula Stock Screener.

Source: finbox.com

Source: finbox.com

Start Today From Only 200. The All-In-One Guru Stock Screener. Benjamin Graham Stock Screener. According to them security analysis does not seek to determine exactly what is the intrinsic value of a given security. He calculates intrinsic value by looking at a companys assets earnings Dividends and financial strength and believes that this is crucial to avoidance of the bandwagon approach to investment.

Source: meetinvest.com

Source: meetinvest.com

The difference between them is called the margin of safety. Advertentie Buy Sell Real Stocks With Regulated EU Stock Brokers. Graham focuses on finding companies with stock that is undervalued against its intrinsic value. Contrary to common belief Benjamin Graham and David Dodd did not provide any indication that they used a formula or a specific algorithm for determining intrinsic value of a common stock. The screener now has more than 120 filters for you to screen your favorite stocks.

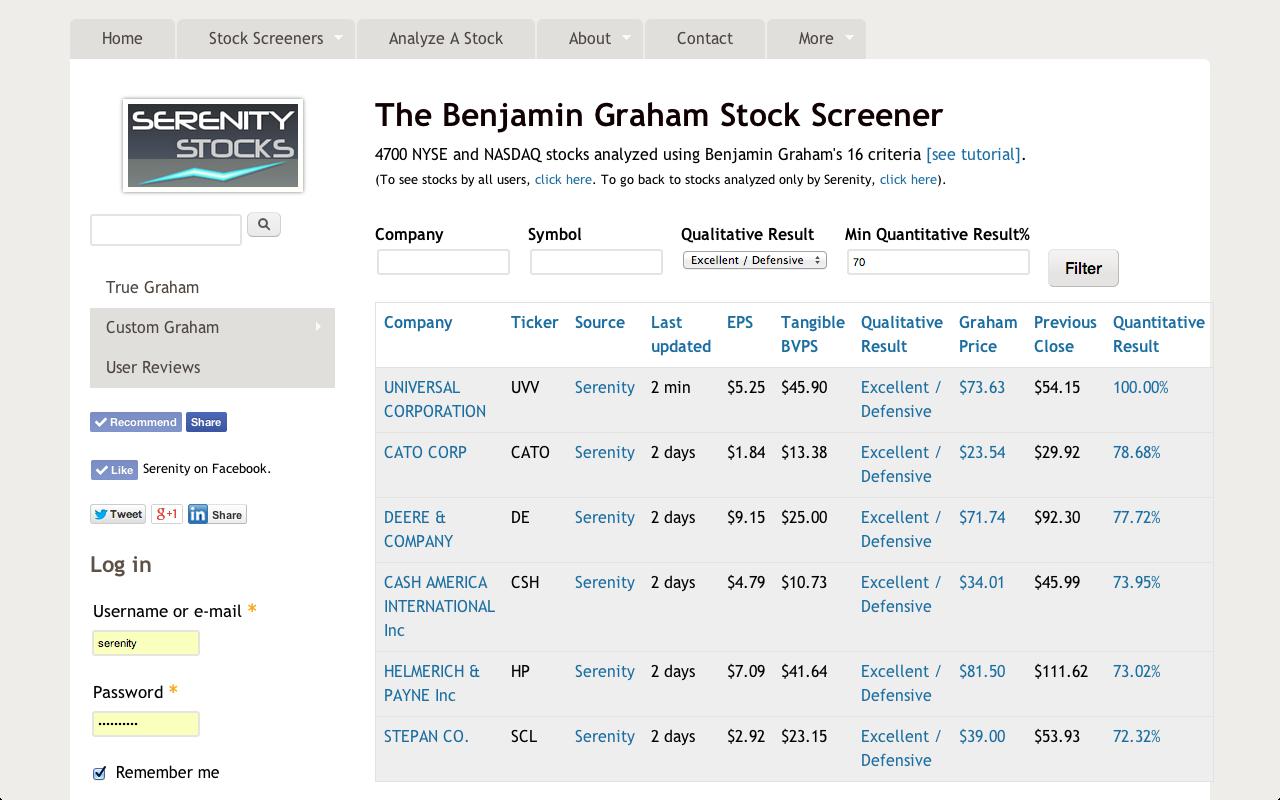

Source: serenitystocks.com

Source: serenitystocks.com

Get immediate access for 2250 or try the free Classic Graham Screener instead. Get immediate access for 2250 or try the free Classic Graham Screener instead. Graham focuses on finding companies with stock that is undervalued against its intrinsic value. Companies with sales lower than this are very small companies and might not have the business stability and. Graham sees great potential for higher returns through investment in undervalued companies which is.

If you find this site serviceableness, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title graham stock screener by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.